Dec 10, 2014 What is Intrinsic Value of Share? We see that the price of a share goes up or down. But if we can calculate the real value of a stock that will be very helpful for the investors. In simple terms, the definition of intrinsic value of share is the discounted value that we can take out from a business during the rest of its life.

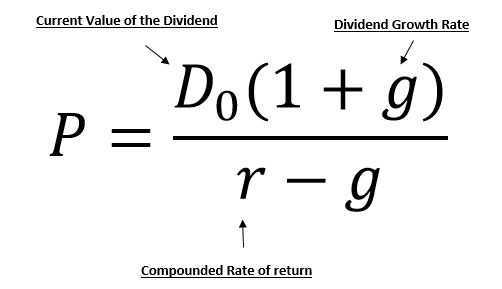

July 29, 2018Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. The same formula we can use to estimate intrinsic value using the absolute PE method. Check this formula: Intrinsic Value (IV) = Absolute PE x EPS. Though this formula may look simple, the trick lies in how to calculate the “Absolute PE” of stock in consideration. This is what we will read in this article. Warren Buffett Intrinsic Value Calculator. The value of a company or any stock, products etc., that is calculated base on the analysis of the financial statements without considering the market rate is termed as the intrinsic value. Warren Edward Buffett, an American business magnate and investor has published some facts on the intrinsic value. Equity Value = Firm Value – Debt value. Then we calculate the intrinsic value per share by dividing the equity value by the total outstanding shares. Intrinsic Value per Share = Equity Value / Outstanding Shares. We can compare the intrinsic value with the stock’s market value to know whether the stock is undervalued or overvalued. DCF Model in Excel.

The richest investor in the world Warren Buffett uses value investing as his core strategy. Reason enough to take a closer look. The core of this strategy is to buy a company, that is much cheaper than its intrinsic value. But what is the intrinsic value? Buffett defines it as following:

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” Warren Buffet

Exactly by this definition we created a intrinsic value calculator, to help you, to invest like Warren Buffett. If you are interested in other Intrinsic Value Calculator articles we have many more.

Intrinsic Value Calculator based on the Discounted Cash Flow model

Value Investing

One of the most successful investment strategies is value investing. Investors like Warren Buffett, Walter Schloss and Charles T. Munger did make a fortune with this strategy. But what is value investing?

Intrinsic Value Spreadsheet

The value investing approach focus on purchasing equities at prices less than their intrinsic values. In terms of picking or screening stocks, he recommended purchasing companies who have steady profits, are trading at low prices to book value, have low price-to-earnings (P/E) ratios, and who have relatively low debt.

Value investing school was founded by Benjamin Graham and David Dodd, both professors at Columbia Business School. In Graham’s book “The Intelligent Investor“, he suggested the concept of margin of safety. This concept was first introduced in the book “Security Analysis“, witch he co-authored with David Dodd.

We recommend that you read both excellent books. They describes step by step what the stock market is. How you can evaluate companies. They also gives you a psychological basis of market fluctuations, investment strategy and so much more. If you want to read only one, read at least “The Intelligent Investor“.

Intrinsic Value

Warren Buffett shares a lot of this investment thoughts in the Berkshire Hathaway reports and homepage. His main approach still today is the value investing strategy he learned from his mentor Benjamin Graham. The core of this strategy is to buy a company that is much cheaper than its intrinsic value. Hold it until it reaches its intrinsic value. Then decide if you sell it with high profits or hold it for dividend payments.But what is the intrinsic value? Warren Buffett describes intrinsic value as following:

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” Warren Buffet

The key is it to calculate the intrinsic value of a business correctly. According to Warren Buffett, this is the hard part. In literature there are various approaches to calculate the intrinsic value. Each model has its own advantages and disadvantages. Even Warren Buffett and Charlie Munger uses different models to calculate the intrinsic value.

“As our definition suggests, intrinsic value is an estimate rather than a precise figure, and it is additionally an estimate that must be changed if interest rates move or forecasts of future cash flows are revised.Two people looking at the same set of facts, moreover – and this would apply even to Charlie and me – will almost inevitably come up with at least slightly different intrinsic value figures.” Warren Buffett

Intrinsic Value Calculator based on the Discounted Cash Flow model

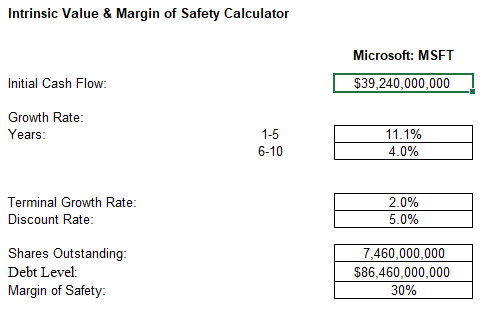

Based on the definition of Warren Buffet, we need to know the discounted value of the cash, that can be taken out of a business during its remaining life, to know the intrinsic value of a company. Based on this definition the Intrinsic Value Calculator based on the Discounted Cash Flow model need the following information:

- The companies annual free cash flow of the last year. This money is left after deducting the costs of maintaining business. Consequently, this is the cash to which the owner is entitled to. Nominally, companies keep a part of it to grow its business.

- How the compaies free cash flow will change in the coming years. We distinguish growth between short and long term. In the short term, growth can be estimated based on historical data. The past growth is simply counted linearly into the future. After a reasonable time of 10 years, we recommend to lower the growth to the level of inflation. We do this, because after 10 years the condition of the business is filled with many uncertainties.

- The discount rate of the free cash flow in the coming years. It describes how much the company’s earned money is worth in the next years. It includes inflation, risk like bankruptcy, sales decline and more. Reasonable are numbers around 10 %. A higher value means a higher risk or higher yield expectation. This consequently requires a higher discount rate. For a lower discount rate it is the other way round.

- The remaining lifetime of the company. Interestingly we don’t need to know this. After 100 years with a discount rate of 10% and a long term growth of 3 % the discounted free cash flow is nearly zero. This is a conservative but reasonable assumption, because it’s unliky that the company still exists. Our calculator calculates even the next 1000 years after your chosen short therm period. You can of course choose different assumption, but then the calculator will not show you reasonable historical accuracy results.

Aside from this the calculation helps you to break it down to one share.

Let’s go over the dis- and advantages of this model:

Advantages of this model:

- The most accurate model I know. If you are using reasonable rates.

- It consider inflation with the discount rate.

- The model calculates the expected yield for your investment.

Disadvantages of this model:

- You need a lot of information, what makes it harder to use.

- It is difficult to anticipate the growth of a company for 10 years.

Intrinsic Value Calculator Excel Download

Thank you for reading.If you are interested in other models we can help you.

How to use the Intrinsic Value Calculator based on the Discounted Cash Flow model

You can left click on all fields to fill them out. We suggest the following order to fill the fields out.

- Fill in the average annual free cash flow of your company.

- Enter your expectations how the free cash flow growth in the short term.

- Fill in what do you consider short term.

- Enter what discount rate would you like to use.

- Fill in your expectations about the free cash flow growth after the company growth period ended.

- Enter the number of common shares outstanding.

- Fill in the market price of your company on the stock exchange.

With this you get the intrinsic value based on your discount rate. If the market price is much lower it maybe a promising investment opportunity. To help you we calculate based on your information the expected yield. If you are searching for an investment with 10 % yield we recommend the following:

- Find a company with little debt!

- Make sure that the business model is stable, future-oriented and you fully understand it!

- Calculate the yield with this calculator. If the result is 12 % with a 2 % margin of safety you have a promising result.

- Buy the stock with a broker that has the highest reputation.

- Don’t hold more than 10 % of your savings in one stock.

- Distribute your stocks over a large field of company’s like automotive, banks, chemistry and much more.

- Hold the stocks till they reaches their intrinsic value. This can be many years!

- Then decide, if you want to sell them or hold them longer for dividend payments.

I wish you the greatest success!

A more detailed description of the fields you will find below.

Average annual free cash flow of your company (Mil $):

The last published free cash flow of your company you can get from the following sites: MSN Money or Morningstar or Yahoo Finance. Morningstar has under Key Ratios / Full Key Ratios Data the best cash flow charts. We recommend using the average of the past 5 years. It’s also reasonable to use a time frame of up to 10 years. Sometimes the company’s free cash flow is not a meaningful indicator. Than we recommend to use 50 % of the average annual net income of the last 5 years. As with free cash flow, you can also use 10 years as an indicator.

Expected free cash flow growth in the short term. (%):

Your expectations how the free cash flow of the company will change in the following years.

What do you consider short term (most common is 10 years)?

Short term here means the period where the growth of this company is assessable. We recommend not to use a longer time then 10 years.

What discount rate would you like to use (%)?

The discount rate describes how much the company’s earned money is worth in the next years. It includes inflation, risk like bankruptcy, sales decline and more. Consequently, a figure of 10 % is appropriate. A higher value means a higher risk or expected yield and consequently requires a higher return. For a lower discount rate it is the other way round.

Free cash flow growth after the company growth period (%):

After the short growth period of your company the growth will most likely be lower. We recommend to use a growth that is not higher than the inflation. At the moment 3 % would be reasonable.

Number of common shares outstanding (Mil. shares):

To calculate the value per share you need to enter the number of outstanding shares of this company. Morningstar has under Key Ratios / Full Key Ratios Data the number of outstanding shares.

Market price of your company on the stock exchange:

To calculate the yield of your investment we need the share price.

Results

Intrinsic value per share with your chosen discount rate ($):

As definition of intrinsic values, we use the definition of the Grandmaster Warren Buffett:

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” Warren Buffet

The intrinsic value calculated by this tool is based on the chosen discount rate.If you choose 10 %, you can expect a annual return of 10 % and judge the company based on this. The Intrinsic Value Calculator based on the Discounted Cash Flow model is quite accurate. Nevertheless we recommend to use 2 or 3 extensive Intrinsic Value Calculator to make sure the investment is promessing. Here you can find more Intrinsic Value Calculators.

Forecast of what your company may yield annually (%):

Based on the market price we calculate the annual yield of you. The annual yield is the investment return you can expect every year. It’s mainly based on the following:

- Divide Payments

- Share price increases in the stock market

Intrinsic Value Formula Excel

Taxes are not taken into account. Consequently taxes can and will lower your annual yield!

Adam Khoo Intrinsic Value Calculator

Thank you for reading! I wish you great success with the Intrinsic Value Calculator based on the Discounted Cash Flow model!

Best Regards, Sebastian H. Schulz